- Alex M

- Case Study

- 0 Comments

Case Study #6: Churn Analysis for a Multi‑Location Healthcare Facility

MemorialCare as a healthcare facility with multiple locations across America, we depend on stable employer relationships and member continuity. This churn analysis looks at two lenses — total churn (employers that fully churned) and employers with decline (still active but shrinking). By pairing a fiscal‑year view with granular breakdowns by month, plan, product, and source, we can see where losses concentrate and why. The result is a clearer playbook for saving at‑risk accounts and for preventing small declines from becoming full churn.

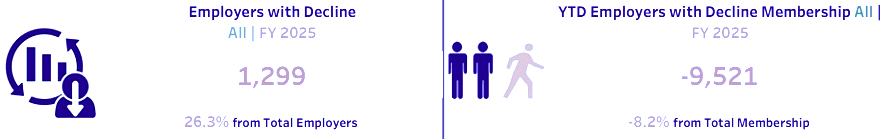

KPI Snapshot (from Churn Dashboard)

Business Challenges

- Losses are uneven across months, making staffing and outreach hard to time.

- Some health plans and product codes are over‑represented in churn, masking root causes behind labels.

- Without a separate view for ‘employers with decline,’ critical warning signs can be missed until it’s too late.

- Attribution is difficult—churn from broker/source, plan benefit changes, or onboarding friction can look similar.

Project Objectives

- Quantify total churn and declining cohorts to guide save‑actions.

- Surface patterns by month, health plan, product code, and acquisition source.

- Prioritize accounts where small declines are likely to escalate.

- Translate findings into targeted retention plays and service fixes.

Our Approach

Step 1: Data Integration & Definitions

We consolidated churn events and membership changes across FY 2025 and standardized definitions: ‘total churn’ (employers that fully left) and ‘employers with decline’ (still active but with net membership loss). We aligned plan names, product codes, and sources, and applied controls to safeguard sensitive information.

Step 2: Visual Storytelling

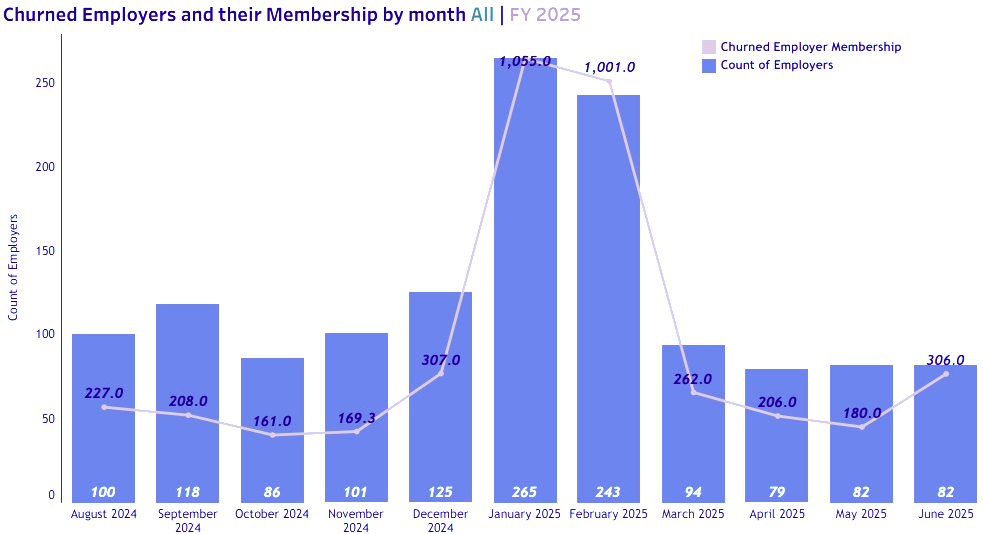

This combo view shows, for each month, how many employers churned and the associated memberships they took with them. Expect visible spikes (e.g., late fall/winter) where both employer count and membership loss jump together.

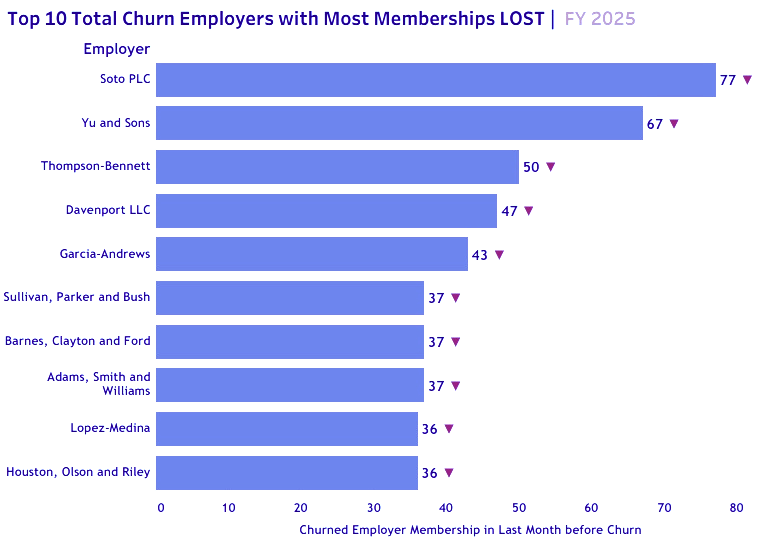

A ranked list of employers that left with the largest membership counts. Use this to review contract histories and service issues, and to set thresholds for proactive save‑actions next cycle.

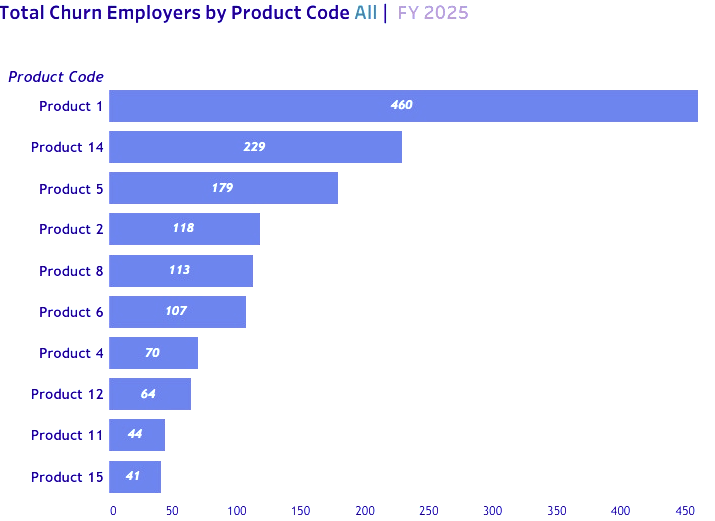

Bars display the number of churned employers by product code. Concentrations around certain codes (e.g., Product 14, Product 5) suggest plan design or service alignment issues.

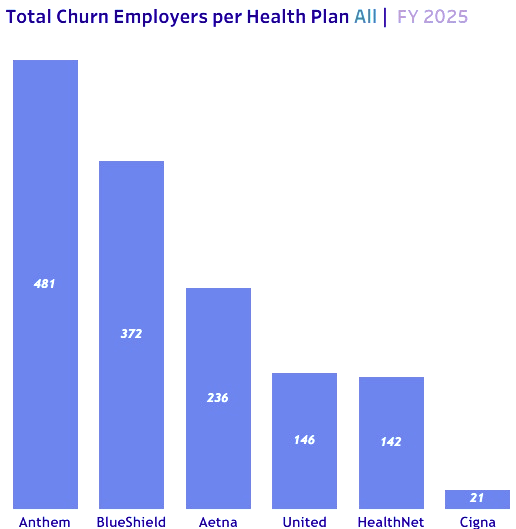

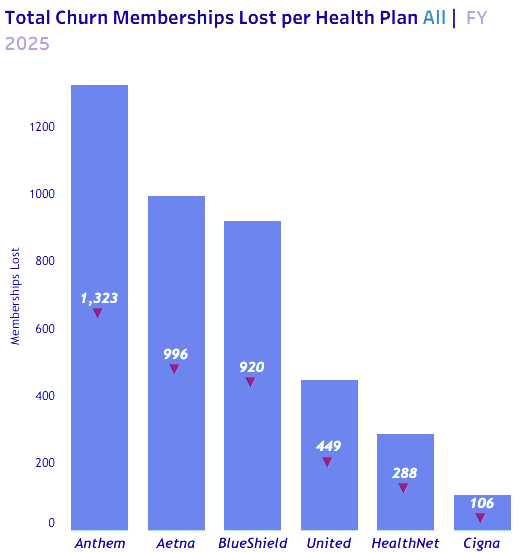

This chart highlights the health plans associated with churned employers. Use this to partner with plans on retention incentives and to refine benefit education where confusion may be driving exits.

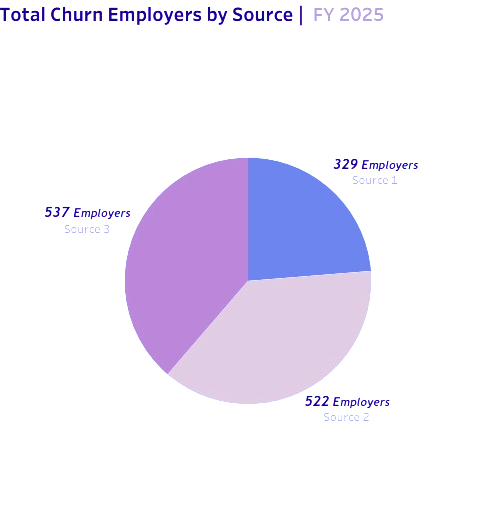

Compare broker/partner sources by employer churn counts and associated memberships lost. Disproportionate losses from a source justify enablement or quality reviews.

-

Source 1: 329 employers churned, and 498 memberships lost

-

Source 2: 522 employers churned, and 847 memberships lost

-

Source 3: 537 employers churned and 2,737 memberships lost

This view shifts from employer count to member impact per product. Larger bars (e.g., Product 1) indicate where to prioritize fixes and where to concentrate renewal messaging.

Membership loss by plan. Higher values (e.g., Anthem, Aetna, BlueShield) call for joint action plans with payers and tailored outreach.

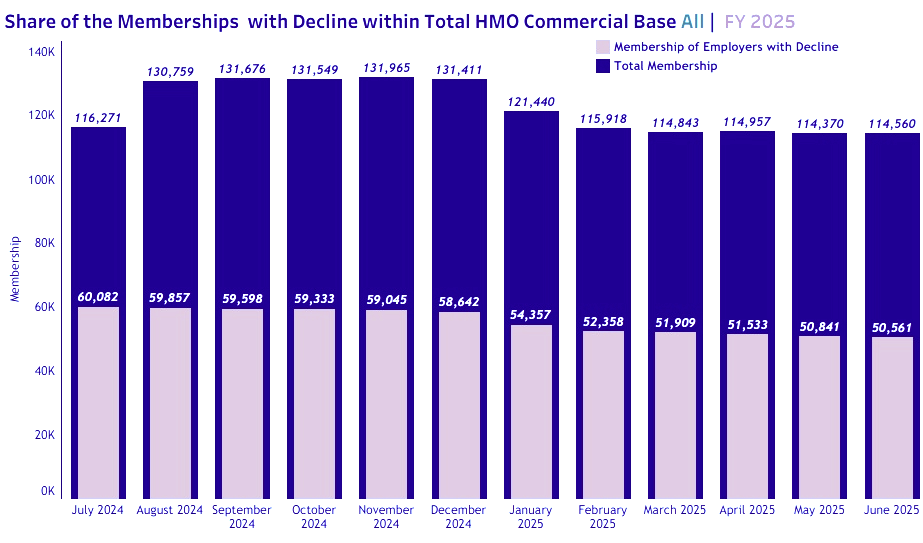

Two lines compare the total HMO commercial base with the share experiencing decline each month. The gap between the lines is a quick signal of overall stability vs. vulnerability.

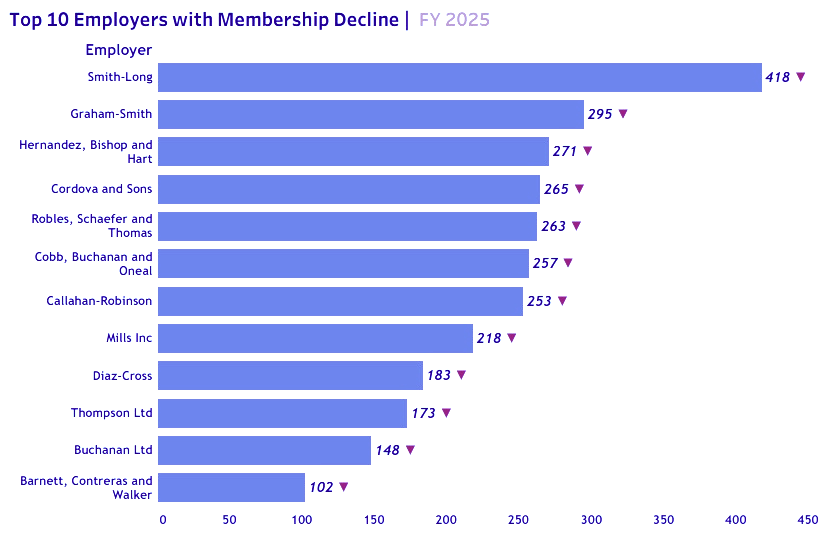

A ranked list of active employers losing the most members. These are prime candidates for executive check‑ins, benefits navigation support, and targeted communications.

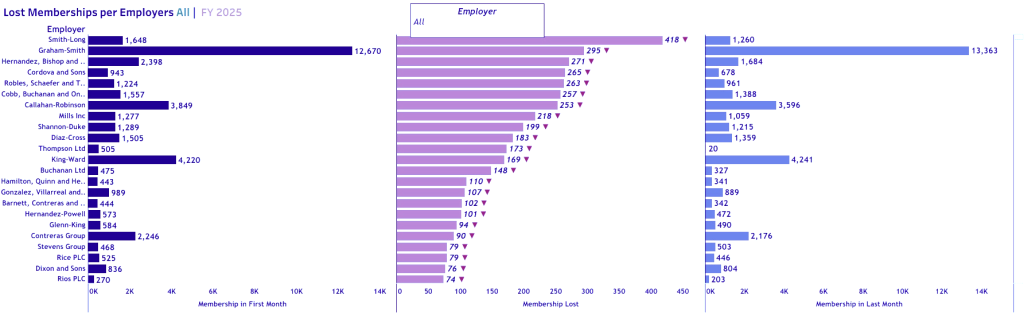

For each top declining employer, this graphic shows membership in the first month, the amount lost, and the last‑month membership. It helps separate reversible dips from structural declines.

Within the ‘employers with decline’ cohort, this chart shows which product codes are most associated with member loss. It’s a starting point for benefit tweaks and targeted education.

Key Insights (What the Data Tells Us)

- Scope of churn: 1,375 employers churned in FY 2025 (24.5% of the employer base), taking 4,082 memberships (‑3.5%).

- Declining cohort: 1,299 employers experienced net declines (26.3%), for a total loss of 9,521 memberships (‑8.2%).

- Product & plan concentration: Churn and decline cluster around specific product codes and health plans, these pockets should shape retention plays.

- Source signal: Broker/partner sources contribute unevenly to churn, the largest source alone accounts for thousands of lost members.

Likely Root Causes & Recommended Actions

- Benefit fit & education: Concentration in certain product codes suggests mismatched coverage or poor understanding — deploy benefit navigators and clearer plan guides.

- Service experience: Spike months often coincide with access or billing friction—introduce rapid‑response squads to resolve issues for at‑risk employers.

- Source quality: Where a source over‑indexes on churn, tighten partner enablement, QA, and joint account planning.

- Renewal timing: Use the declining‑cohort list to stage executive check‑ins 60–90 days pre‑renewal, prioritizing top membership impact.

Business Impact

By separating full churn from early declines and adding plan/product/source context, leaders can intervene earlier and more precisely. That improves employer retention, protects member continuity, and stabilizes clinic utilization across locations.

Conclusion

Churn is inevitable, but preventable in many cases. With a shared dashboard and targeted playbooks, this multi‑location healthcare facility can turn monthly insights into timely save‑actions—keeping more employers engaged and more members covered.

Tools used